On June 7, Ontario citizens elected a new Conservative government which had made several transportation policy announcements during the election campaign. One was a promise to cut the provincial gasoline tax by 10 cents: 5.7 cents from the current 14.7 cent excise tax and 4.3 cents from cancelling Ontario’s participation in the Cap-and-Trade Program (CTP) with Quebec and California. The government said it would fulfill this pledge soon after it is sworn in on June 29.

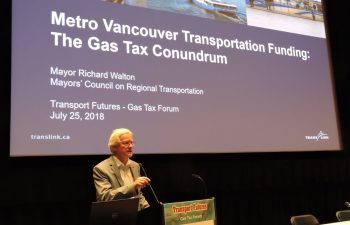

Since a tax on gasoline is an essential mobility pricing measure used in jurisdictions around the world, Transport Futures facilitated a special Forum on July 25 — the same day as the government’s CTP cancellation legislation was tabled. Politicians, academics and analysts from the fuel, transit, environmental and construction sectors discussed the pros and cons of cutting the gas tax in terms of:

Our interactive agenda provided delegates with ample time to pose questions to our speakers, understand the complexities of lowering gas taxes and network together. Based on evaluations received, more than 80% said the Forum met or surpassed their expectations while 90% said it was good value for money. Here are a few testimonials:

The Gas Tax Forum was generously sponsored by the Residential and Civil Construction Alliance of Ontario (Platinum), 407 ETR (Gold) and the Ontario Good Roads Association (Bronze).

Transportation Futures

is a project of

Healthy Transport Consulting